Ministers are backing a tougher anti-fraud clampdown, while privacy groups warn vulnerable people could be caught in the net.

From April 2026, the Department for Work and Pensions plans to require banks to flag unusual activity on accounts. The Public Authorities (Fraud, Error and Recovery) Bill would underpin the checks with new data powers, financial penalties and reporting rules, aiming to recover public money and deter abuse.

When the checks start

Officials say the new regime is scheduled to begin from April 2026. The exact launch day has not been confirmed and still depends on the Bill’s passage through Parliament.

Peers are set to examine the legislation in detail on 15 October and again on 21 October. Ministers argue that early preparation is vital so systems are ready for a phased rollout in the spring.

Planned start: April 2026. Parliamentary scrutiny: 15 and 21 October. The DWP wants the framework in place before the new tax year.

Who will be targeted first

Specialists briefed on the plans expect the early phase to focus on three benefits where the DWP sees a high risk of error and fraud. These are mass-payment systems with complex rules and frequent changes of circumstance.

- Universal credit: fluctuating earnings and household changes often alter entitlement.

- Pension credit: mixed incomes and savings rules can be misunderstood or under-reported.

- Employment and support allowance (ESA): health status and work capability assessments affect payments.

The department has not named individuals or produced target lists. Instead, banks would supply signals where account activity appears inconsistent with the level of benefit claimed, prompting a human review at the DWP.

Early focus: universal credit, pension credit and ESA. Banks provide signals; DWP caseworkers make any decisions.

What the Bill changes

The Public Authorities (Fraud, Error and Recovery) Bill creates powers to require third parties, including banks, to provide specified information so officials can run eligibility checks and spot anomalies quickly. It also introduces civil penalties so some cases can be resolved without court proceedings.

Ministers claim the package will save £1.5 billion over five years and contributes to a wider plan to save £9.6 billion by 2030. They say this protects the public purse and supports frontline services.

| Item | Detail |

|---|---|

| Planned start | April 2026 (exact day to be confirmed) |

| Peer scrutiny | 15 and 21 October |

| Projected savings | £1.5bn over five years |

| Wider savings plan | £9.6bn by 2030 |

| Initial focus | Universal credit, pension credit, ESA |

How the bank checks are expected to work

Under the proposals, banks would run defined checks to identify patterns that could signal risk, then pass limited information to the DWP. The department says it will not use this data to assume guilt. Any signal would prompt a caseworker to look at the person’s circumstances in the round before any action.

“The information provided by banks is unrelated to DWP algorithms and any signals of potential fraud will always be looked at comprehensively by a member of staff,” a spokesperson said.

Officials also point to new oversight and reporting rules, plus staff training, to prevent misuse and ensure proportionate handling. The department insists these are targeted compliance tools rather than blanket monitoring of the public.

Why campaigners are worried

Disability Rights UK, Age UK, Privacy International, Child Poverty Action Group and Big Brother Watch have all raised concerns. They warn that algorithmic or suspicionless surveillance could replicate the kind of systemic failure seen in the Post Office Horizon scandal, where faulty systems drove wrongful accusations with devastating personal consequences.

“Pensioners, disabled people, and carers shouldn’t have to live in fear of the government prying into their finances,” one letter to ministers warned.

Groups fear false flags could deter genuine claimants from accessing the support they need. They also question whether people will receive clear explanations if their account triggers a check, and whether redress routes will be swift and accessible.

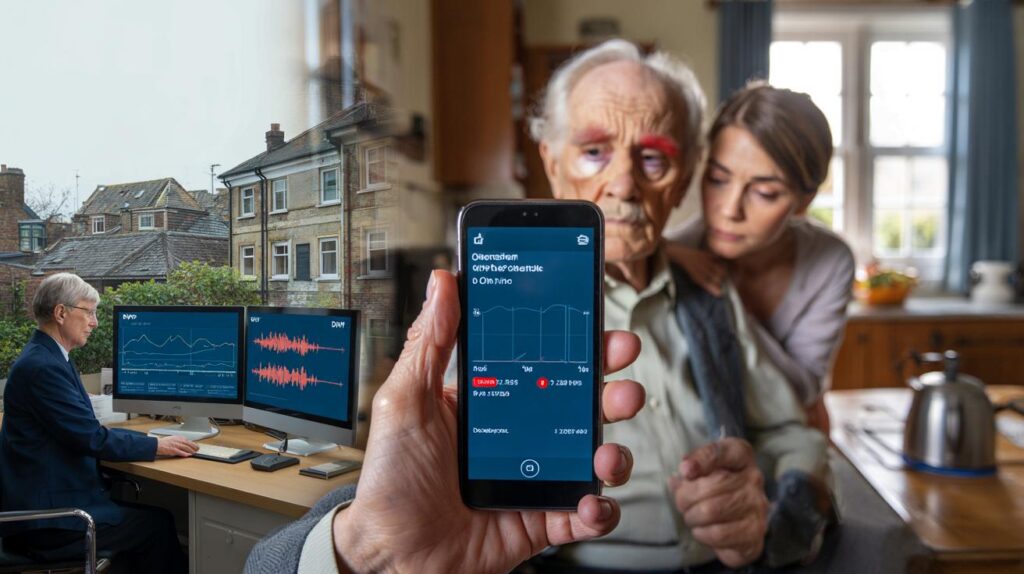

What this could mean for pensioners, disabled people and carers

Advocates worry that people with complex finances or irregular transactions—such as carers juggling part-time work or disabled claimants with frequent medical expenses—could face extra scrutiny. They want safeguards so that context is considered and evidence from claimants is weighed fairly.

Penalties, appeals and your rights

The Bill gives the DWP the option to issue financial penalties instead of taking some cases to court. Ministers say this offers a faster route for low-level non-compliance and reduces burdens on courts. Critics want clear thresholds for when penalties apply, and firm routes to contest them.

If you are contacted about a suspected overpayment or potential fraud, you can ask the department to set out the basis for its concerns. You can also challenge decisions and provide evidence that explains your transactions or changes of circumstances.

- Request a written explanation of any decision, including the evidence relied upon.

- Use a Mandatory Reconsideration to challenge an overpayment or penalty within the stated deadline.

- Appeal to an independent tribunal if you disagree with the reconsideration outcome.

- Seek free, independent advice from welfare rights charities for help with evidence and deadlines.

How to prepare now

Keep your claim up to date. Report changes in earnings, savings, household composition and residency as soon as they happen. Retain bank statements and key documents so you can explain unusual transactions if asked. If you use universal credit, make notes in your journal when finances shift, such as overtime or a temporary second job.

If a bank flag triggers a DWP check, context matters. For example, a lump-sum payment could be a reimbursed expense or a refundable deposit; a sudden drop in spending might be linked to a hospital stay. Provide clear dates and documents to show the full picture.

What remains unclear

The government has not confirmed the exact go-live day in April 2026, the precise data fields banks will share, or the thresholds that will prompt a signal. Guidance on how long data is retained, how often re-checks occur, and how quickly people can correct errors is expected closer to rollout.

Until the House of Lords finishes its scrutiny and the Bill’s final text appears, the scope could shift. Claimants should watch for official updates through the DWP and benefit service portals so they understand any new obligations well ahead of April 2026.

If banks are only sending “signals”, what exactly counts as inconsistent activity? Will thresholds be published, and for how long will those data pings be retained? I’d like to see a clear route: signal -> human review -> explanation request -> appeal. Otherwise this feels like suspicion-first, evidence-later.

So my £3.50 coffee spree triggers DEFCON 1? Asking for a frend 🙂 Also, who tells me first—the bank or DWP—if my acct gets flagged?