Quiet conversations about new fraud powers are getting louder. Privacy fears are growing. Claimants want clarity. Ministers promise results.

The Department for Work and Pensions has now confirmed when enhanced eligibility checks, including bank account monitoring, will roll out. A phased start from April 2026 will aim to cut fraud and error while keeping payments flowing to those who qualify.

What is changing and when

From April 2026, the government will introduce new data-driven eligibility verification. The move sits within the Public Authorities (Fraud, Error and Recovery) Bill, a package champions say will protect the public purse over five years.

Start date: April 2026. Purpose: reduce fraud and error. Five-year savings target: £1.5bn.

Officials say the programme will begin with a “test and learn” phase. That means the rules and processes will be piloted, reviewed and adjusted before widening out. The intent is to apply the powers proportionately. Guidance and codes of practice will be published, and the government says it will keep working with financial firms to refine how data is shared.

Which benefits are in the first wave

Industry watchers expect the earliest checks to focus on three large payments where fraud or error can be costly and complex to detect:

- Universal credit

- Pension credit

- Employment and support allowance (ESA)

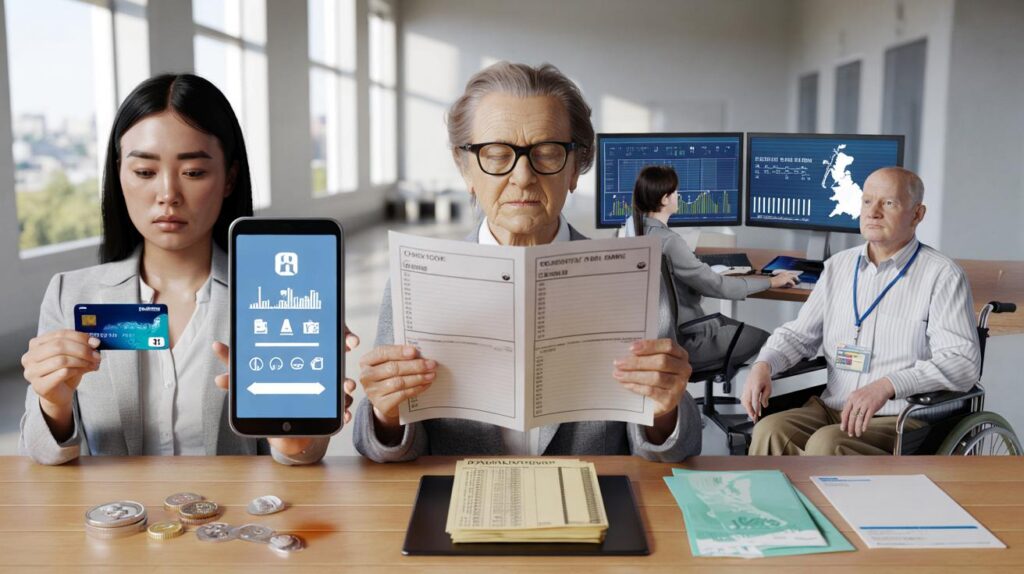

These systems are diverse. Universal credit spans working-age claimants with changing earnings. Pension credit supports older people, often with savings assessed against capital limits. ESA includes people with limited capability to work. The DWP’s initial targeting suggests it wants to test different patterns of risk across age groups and household types.

The government says data used to verify eligibility will not be shared on the presumption of guilt.

How the bank checks are expected to work

The DWP says banks will supply information that points to possible mismatches with entitlement rules. That could include signals such as unusual balances against declared capital thresholds, repeated overseas activity that conflicts with residency rules, or patterns suggesting unreported income. The department insists it will not rely on opaque algorithms to make decisions about individuals.

The DWP says any flags raised will be reviewed by a member of staff, not decided by an algorithm.

Officials also stress staff will receive training and that oversight and reporting requirements will apply. The message is that a human decision-maker will weigh context and ask for evidence, rather than switching off payments based solely on data signals.

Why ministers say the checks are needed

Benefit fraud and error cost billions each year. Ministers argue that sharing limited, targeted data is better than widespread intrusive inquiries. They claim that smarter checks will speed up corrections, reduce overpayments, and protect funds for those who qualify. The £1.5bn forecast savings over five years signal the scale of ambition.

For many claimants, faster resolution can help. If a system spots an error early, repayments are smaller and stress is lower. The risk is in striking the balance between vigilance and fairness.

Oversight, safeguards and accountability

The government promises clear safeguards. That includes codes of practice, published guidance and cooperation with the financial sector. It has also said new reporting rules will create an audit trail of how powers are used.

The DWP states that data supplied by banks is separate from any internal risk models and that staff will examine circumstances before changing an award. Expect the department to set out how it measures accuracy, overturn rates and claimant experience as the trials expand.

Campaigners raise red flags

Rights groups including Disability Rights UK, Age UK, Privacy International, Child Poverty Action Group and Big Brother Watch have warned that bulk financial monitoring could be disproportionate. In a letter to Work and Pensions Secretary Liz Kendall, they argue that “suspicionless” data trawls risk repeating past tech failures, referencing the Horizon scandal as a cautionary tale. They fear pensioners, disabled people and carers could be wrongly flagged and face distressing challenges to their entitlement.

The DWP says those claims are inaccurate, and that the programme will be proportionate with strong oversight. Anticipate continued scrutiny in Parliament and from the Information Commissioner as the start date approaches.

What this could mean for you

Most claimants who keep their details up to date should not see changes beyond occasional requests for evidence. Where a data signal suggests a mismatch, you are likely to be contacted to confirm information. Keeping records will reduce delays.

Common triggers that may prompt a review

- Capital that appears to exceed the limit for your benefit.

- Regular payments that look like earnings or undeclared income.

- Activity that suggests you may have moved abroad while claiming.

- Multiple accounts or name mismatches tied to one claim.

- Frequent large cash deposits that conflict with declared circumstances.

Key facts at a glance

| Measure | Detail |

|---|---|

| Start date | April 2026, with a phased “test and learn” rollout |

| Target benefits (first wave) | Universal credit, pension credit, and ESA |

| Projected savings | £1.5bn over five years, across fraud and error reduction |

| Decision-making | Human review of any flagged cases; training and reporting promised |

| Safeguards | Codes of practice, guidance, and cooperation with industry |

How to prepare before April 2026

Update your contact details and bank information with the DWP. Check that names match across accounts. If you have savings, keep statements and note any one-off sums such as gifts, compensation or redundancy payments. If your circumstances change, report it promptly through your usual channel.

If contacted about a check, respond within the deadline. Provide bank statements or payslips if asked. If you need extra time, request it in writing and keep copies of correspondence.

If you are flagged or disagree with a decision

Ask for an explanation of what triggered the review and which rules are in question. Provide evidence that addresses those points first. If your payment is reduced or stopped and you think this is wrong, request a Mandatory Reconsideration within one month of the decision letter. If the decision stands, you can appeal to an independent tribunal.

You can make a subject access request to the DWP for records it holds about your case. You may also ask your bank for information shared under the new powers, once those processes are in place. If you believe data has been mishandled, you can raise concerns with the organisation and, if unresolved, complain to the regulator.

What to watch as the rollout nears

Look for clarity on exactly what data banks will send, how often checks will run, and how quickly cases will be reviewed. Pay attention to published guidance for staff and any independent evaluation of accuracy. Early statistics on false positives, overturn rates and repayment demands will show whether the system is proportionate.

Households on universal credit with fluctuating earnings may see more frequent queries, so keeping digital records of payslips and bank entries can save time. Pension credit claimants should track capital and state any disregarded funds clearly. ESA claimants should keep medical and work capability documents to hand if entitlement is cross-checked.

£1.5bn over five years sounds optimistic—how exactly are “savings” measured? Are prevented overpayments counted the same as recovered cash, and will you publish the assumptions behind those figures?

After Horizon, why should we trust “data signals”? If I’m flagged, will the letter show the precise trigger (e.g., balance over X on date Y) or just vague wording? Transparency matters.