A tougher stance on benefits is sweeping the UK, with officials sharpening tools and household budgets feeling the pressure.

Ministers have backed a ramp-up in checks designed to catch fraud and cut error. That means more letters, more evidence requests and, for some, a visit from investigators. Claimants are being warned to keep details current and documents ready.

What is changing and why it matters to you

The Department for Work and Pensions says it will step up investigations where it suspects false claims or undeclared changes. Officials say the focus is on deliberate fraud, not genuine mistakes. But an error that goes uncorrected can still trigger recovery of overpayments and penalties.

Investigators are widening the use of interviews and home visits. The push targets cases where income, savings or living arrangements do not match what was declared. Local councils and HMRC can take part in checks. Data sharing helps to spot inconsistencies.

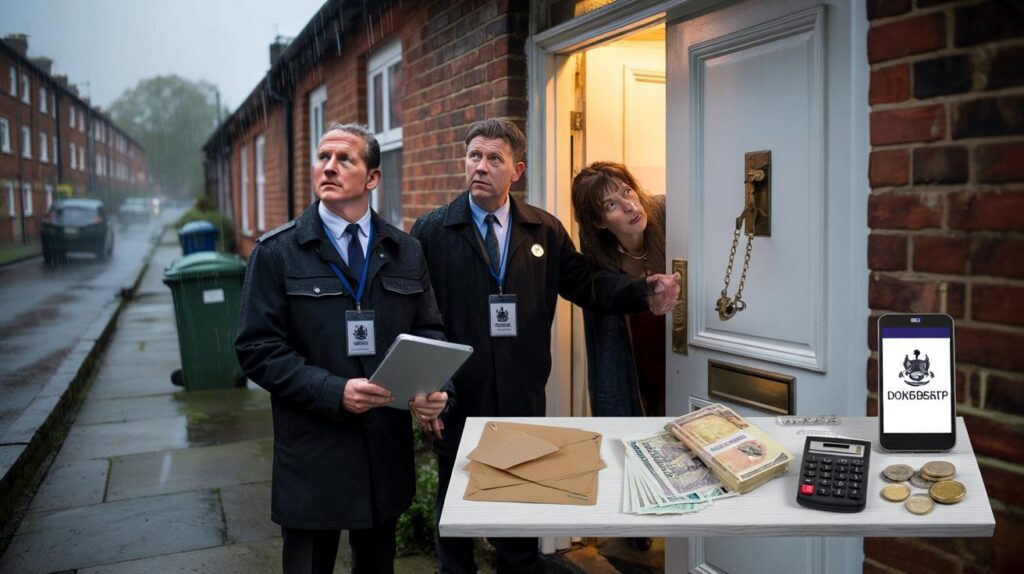

Fraud Investigation Officers can visit your home or call you to an interview under caution if your claim is flagged.

How an investigation may start

Letters, calls and a knock at the door

You might first hear from the DWP, HMRC, your local council or Defence Business Services. The contact should explain what they need and how to respond. Keep the letter, note the date and name of the officer, and reply by the deadline.

In some cases, a home visit is arranged. Officers will show identification and ask to discuss your claim. Visits can be rescheduled if the time does not suit. If you feel unsure, you can ask for the enquiry in writing and request a new appointment.

Interview under caution

You can be asked to attend an interview under caution. This is formal and often recorded. You may bring a representative, such as a solicitor or a trusted support worker. The officer will set out concerns and ask questions about your circumstances.

Answer clearly and provide documents when asked. If you need time to find paperwork, say so. If you do not understand a question, ask for it to be repeated. The recording can form part of a criminal investigation.

Your benefit can be paused during checks. You should receive a letter if payments are suspended.

What counts as benefit fraud

Fraud means claiming money you know you are not entitled to. That can include providing false information or failing to report a change. Examples include moving in with a partner and not telling the DWP, starting a job but not reporting earnings, or keeping quiet about savings that rise above limits.

- Not reporting a partner moving in or moving out.

- Starting work, extra shifts or self‑employment without updating your claim.

- Savings or investments growing beyond the threshold and not declaring them.

- Children leaving full‑time education, care or custody, affecting entitlements.

- Travelling abroad for longer than your benefit rules allow.

- Claiming from an address where you no longer live.

Genuine mistakes happen. If you spot one, correct it quickly via your online account, by phone or in writing. Early correction reduces overpayments and can avoid penalties.

Penalties, sanctions and what happens next

If officials find evidence of fraud or an attempt to commit it, you can be asked to repay all overpaid amounts. You can also face an administrative penalty. That penalty can range from £350 to £5,000, depending on the case.

Serious or repeated cases can go to court. Conviction can lead to a criminal record and additional fines. Separately, benefit sanctions can apply. A sanction can reduce or stop certain benefits for up to three years. The length depends on the number and nature of offences.

Penalties between £350 and £5,000 can be added to the overpayment, and sanctions can last up to three years.

At‑a‑glance: investigation outcomes

| Outcome | What it means | What to expect |

|---|---|---|

| Overpayment recovery | Repay the benefits you were not entitled to | Repayment plan or deductions from ongoing benefits |

| Administrative penalty | Extra charge on top of the overpayment | Fixed amount, often between £350 and £5,000 |

| Prosecution | Criminal court case for alleged fraud | Possible fine, criminal record, and costs |

| Sanction | Payments reduced or stopped for a set period | Up to three years for repeat offences |

The 19 benefits that can be cut or stopped after fraud

Only some payments are sanctionable. If the benefit linked to the fraud cannot be reduced, other sanctionable benefits can be cut instead. These 19 payments can be reduced or stopped if fraud is proven:

- Carer’s Allowance

- Employment and Support Allowance

- Housing Benefit

- Incapacity Benefit

- Income Support

- Industrial Death Benefit

- Industrial Injuries Disablement Benefit

- Industrial Injuries Reduced Earnings Allowance

- Industrial Injuries Retirement Allowance

- Industrial Injuries Unemployability Supplement

- Jobseeker’s Allowance

- Severe Disablement Allowance

- Pension Credit

- Universal Credit

- War Disablement Pension

- War Widow’s Pension

- War Pension Unemployability Supplement

- War Pension Allowance for Lower Standard of Occupation

- Widowed Mother’s/Parent’s Allowance

How to protect your claim

Keep records and share changes quickly

Report any change in your situation as soon as it happens. Use your Universal Credit journal, call the relevant helpline or write to the office named on your award letter. Keep copies of messages and receipts of submission.

- Store payslips, bank statements and P60s for at least 15 months.

- Keep tenancy agreements, council tax bills and utility statements.

- Note dates when a partner moves in or out, or when a job starts or ends.

- Record travel dates if you go abroad, even for short trips.

If you are contacted by investigators

Stay calm and read the letter carefully. Call the number provided if anything is unclear. Ask what documents are needed. If you cannot attend an interview at the proposed time, request another slot. You can bring someone with you for support, including a legal adviser.

During a home visit, you do not have to answer immediately if you need time to find evidence. You can arrange a follow‑up. Check the officers’ identification and write down the reference number. If your payment is suspended, budget for the gap and ask about hardship support if you are at risk.

If in doubt, report the change. A quick update now can prevent an overpayment and a sanction later.

Useful context to help you plan

Most investigations end with overpayment recovery rather than court. Officers look for intent. They weigh how promptly you corrected any errors and whether you cooperated with requests. Keep communications polite and factual. Provide what you have and explain what you are still gathering.

If you think a decision is wrong, you can ask for a mandatory reconsideration. Deadlines are short, so act quickly. Gather evidence that supports your position, such as payslips that prove dates or bank statements that show balances below thresholds at the relevant time.

A quick self‑check before any visit

- Do your declared earnings match your recent payslips and bank credits.

- Does your savings level match what you have reported.

- Have you told the DWP about any partner, lodger or dependent changes.

- Have you kept proof of rent, council tax and childcare costs where relevant.

- Have you recorded any time spent abroad within your benefit rules.

Taking ten minutes to line up this information can save hours later. It can also reduce the risk of a suspension while checks are completed.

Useful guide. One thing I’m unsure about: how do we verify an investigator’s identity at the door without sharing personal info first? Also, if we ask for everything in writing, does that pause any deadlines, or do we still need to reply by the original date?