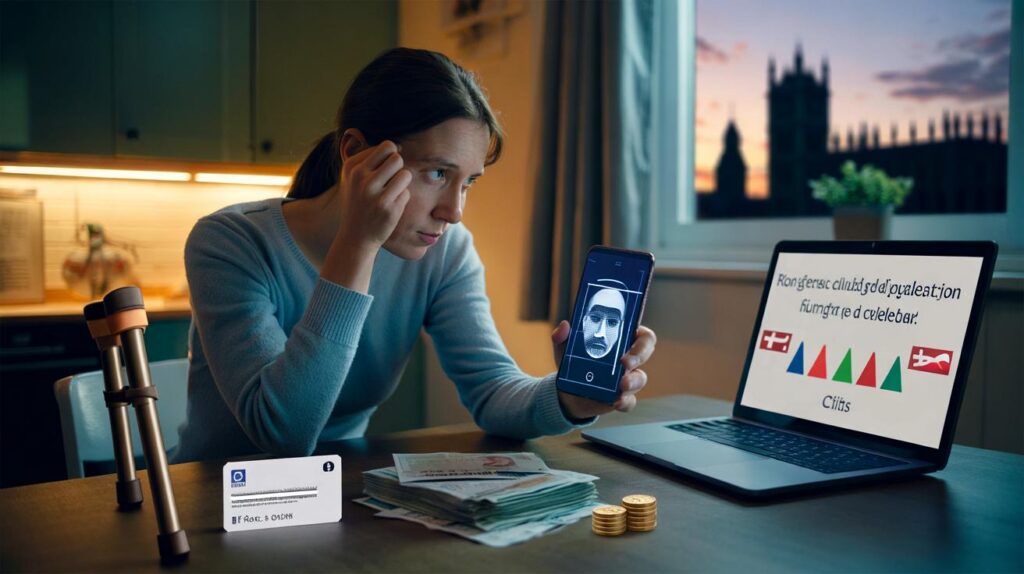

Millions relying on disability support face fresh scrutiny as ministers prepare a major welfare bill billed as protecting taxpayers.

The Department for Work and Pensions has outlined a tougher approach around Personal Independence Payment, with a draft law and operational changes aimed at cutting fraud and errors. Supporters say the plans protect public money. Charities warn the tone risks scaring legitimate claimants away from help.

What the three measures mean for PIP claimants

Officials say three practical moves will roll out across PIP operations. The department highlights bank detail checks, stronger identity proofing, and staff training to spot suspicious cases earlier. The goal is to block suspect claims at the door and move faster on red flags within existing awards.

Three pillars sit at the heart of the plan: tighter bank-change checks, wider frontline training, and tougher identity verification before awards get through the system.

| Measure | What changes | Who it may affect |

|---|---|---|

| Stricter checks on changes to personal details | Closer scrutiny of alterations such as new bank accounts, addresses or contact details | Existing claimants who report updates; new claimants awaiting first payment |

| Awareness sessions for case managers and clinicians | Training on risk indicators and next steps when something looks off | DWP decision-makers, assessment providers, and contracted healthcare professionals |

| Bolstered identity and verification (ID&V) | Stronger proof-of-identity checks to prevent suspect applications entering the system | All new applicants and transfers between claims |

For most people, this means extra questions when updating details and a greater emphasis on evidence that shows who you are and why you qualify. The department frames the changes as proportionate, though they will add friction to an already demanding process.

Why now: the numbers behind the crackdown

Latest figures show £330 million lost to fraud and error in PIP over the last year, up sharply from £90 million in 2023/24. The department points to that jump as proof the system needs shoring up. Nearly four million people receive PIP, so even small percentages create large cash sums.

Fraud makes headlines, but it accounts for a small slice of overpayments. The wider challenge also includes mistakes made by both claimants and administrators.

Turn2us, a national poverty charity, cautions against a blanket narrative that paints claimants as cheats. It highlights government-wide data showing that 2.8% of spending on overpayments arose from fraud in the year to 2024. Its message: crack down on fraud, but keep the focus on support for people who qualify.

The bill in Parliament: new powers and new guardrails

The Public Authorities (Fraud, Error and Recovery) Bill seeks to refresh the legal framework used to prevent, detect and recover money lost to fraud and mistakes across the public sector. Ministers argue that modern data sharing and faster recovery tools will protect taxpayers and deter abuse.

Campaigners are watching one area closely: recovery of overpayments and suspected fraud. The charity sector warns that the draft legislation could open the door to recovering funds direct from bank accounts in certain circumstances. They say that risk, or even the idea of it, may deter genuine claimants from applying in the first place.

The bill aims to harden defences against fraud and error. Support groups want explicit safeguards so genuine claimants do not face heavy-handed recovery or chilling effects.

Parliamentary timetable

The bill continues its passage at Westminster, with the report stage set for 15 October. MPs can refine clauses, add safeguards and tighten definitions. The final shape of the powers will depend on amendments agreed in the coming weeks.

What you should do if you receive PIP

You can reduce the risk of delays or disputes by keeping your claim orderly and evidence-led. A few practical steps help your case move smoothly.

- Report changes quickly: medical updates, care needs, address or bank details.

- Keep records: appointment letters, care plans, prescriptions and clinician notes.

- Match details: ensure your name and address match on bank, GP and DWP records.

- Respond on time: reply promptly to letters, texts or calls from the department.

- Challenge errors: ask for a mandatory reconsideration if you believe a decision is wrong.

- Seek advice: welfare rights services can help with forms, evidence and appeals.

PIP at a glance: who gets what

PIP supports extra costs for people with long-term health conditions or disabilities affecting daily living or mobility. Awards come in two components, each with two rates. The amounts below reflect current weekly rates for the 2024/25 financial year.

| Component | Standard rate (per week) | Enhanced rate (per week) |

|---|---|---|

| Daily living | £72.65 | £108.55 |

| Mobility | £28.70 | £75.75 |

An assessment looks at how your condition affects tasks like preparing food, managing therapy or moving around. You can receive one component or both, at different rates, depending on your score.

What tighter checks mean in practice

Expect more questions if you change your bank account or move home. Staff may ask for extra documents when names or addresses do not match across records. New applicants may need stronger identity proof, such as photo ID plus corroborating evidence. Clinicians and case managers will receive fresh training on risk signs, which could trigger additional verification steps or a review.

Legitimate cases should still go through, though timelines might lengthen where evidence is sparse or inconsistencies appear. Keep your paperwork tidy and consistent. If you cannot provide a requested document, explain why and offer alternatives, such as a GP letter or recent official correspondence.

Fraud, error and overpayments: know the differences

Fraud involves deliberate misrepresentation. Error can arise from misunderstandings, form mistakes or administrative slips. Overpayments can result from either. If you receive an overpayment letter, you can ask for the calculation, the evidence used and a repayment plan that reflects your means. Charities advise people not to ignore letters, as early engagement can prevent harsher action.

Received an overpayment notice? You can request a breakdown, challenge the decision and agree an affordable repayment plan.

Key risks, and the potential upside

The plan may catch organised fraud earlier. It could also generate more checks for genuine claimants, raising stress and processing times. The risk of false positives exists when data does not match across systems. People with fluctuating conditions may face more frequent reviews as staff respond to new training triggers.

On the upside, better training could improve decision quality and reduce basic errors. Stronger identity checks may cut delays caused by missing or mismatched documents if the process becomes clearer and more consistent nationwide.

What to watch next

Keep an eye on the report stage on 15 October for any amendments setting out explicit safeguards, thresholds for data access, and oversight of recovery powers. Guidance to staff often shapes how laws operate on the ground; updated manuals and provider instructions will show how assertive the department plans to be.

If you plan to apply soon, assemble your evidence pack now and line up identity documents. If you already receive PIP and need to change bank details, prepare supporting documents in advance to avoid payment disruption. Those steps can ease the extra friction built into the new checks while the bill completes its route through Parliament.

What happens to claimants who don’t have current photo ID or a stable address? The piece mentions alternative evidence like a GP letter, but will that actually satisfy the bolstered ID&V in practice? Many disabled people juggle frequent moves or name mismatches across records. Please publish clear, accessible guidance so people don’t get stuck in limbo just because thier documents aren’t “perfect” the first time.

£330m sounds huge, but how much is deliberate fraud versus DWP/assessment errors? Your own quote notes mistakes by both sides. If the response is more friction and suspicion, genuine claimants pay the price. Measure outcomes, not headlines—did overpayments drop without increased wrongful denials? Otherwise this is definately performative policy.