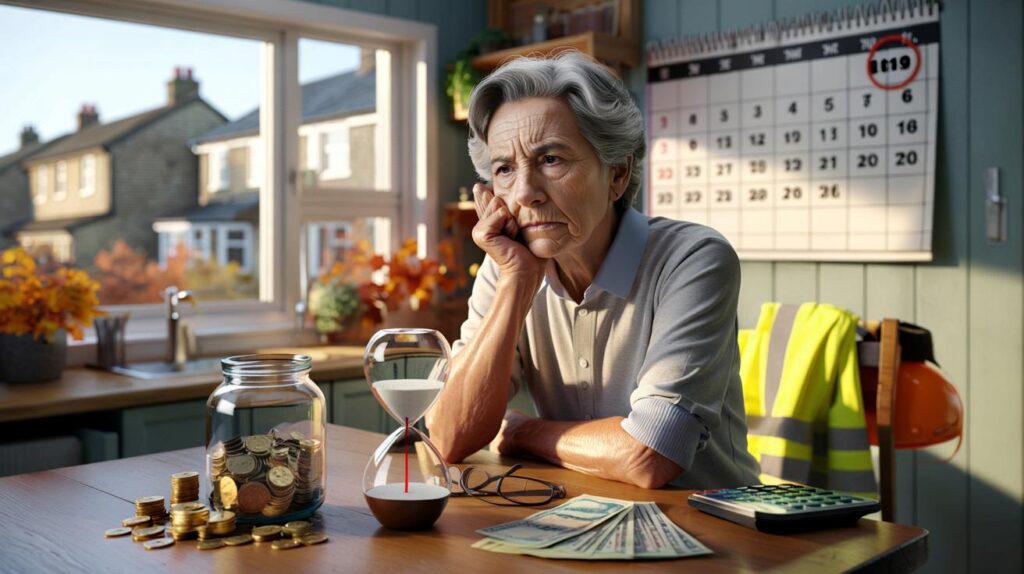

A small change this autumn could reshape retirement dates, monthly cashflow and plans you thought were locked in years ago.

From October 2025, the UK will raise the State Pension Age and tighten eligibility in places, shifting when many people can first claim. Here is what the shake‑up means in practice, who will feel it most, and the realistic steps that protect your income.

What changes in October 2025

The government will nudge the State Pension Age (SPA) higher and adjust eligibility rules. The impact lands on people who reach their claim date on or after October 2025. Your earliest start date may move back, and your final weekly amount will depend more sharply on your National Insurance (NI) record.

If you reach SPA from October 2025, your claim window could open later than planned and your payment may change if you have NI gaps.

| Area | What shifts from October 2025 |

|---|---|

| Effective date | Changes apply to claims due on or after October 2025 |

| Who is affected | Men and women reaching SPA from that month onwards |

| Core impact | Later claim date for some; tighter focus on NI qualifying years |

| Reason | Longer life expectancy and the need to keep the system financially sustainable |

Who is affected and by how much

If your planned claim month falls in October 2025 or later, you sit in the frame. The shift applies across the board, not by gender, and it touches those within months of retirement hardest because plans are already set.

- Planned to stop work this autumn: you may need interim income or to work longer.

- Working part‑time: a small delay can still strain cashflow if you rely on the pension to top up wages.

- Mixed careers with caring breaks: NI gaps could trim your weekly amount unless you hold credits or top up.

- Living abroad: you still need enough UK qualifying years; your payment may not uprate in some countries.

Eligibility rules that now bite harder

Your State Pension is built on qualifying years of NI. Most people need at least 10 qualifying years for any payment, and around 35 for the full new State Pension. Gaps reduce the weekly amount, even if you meet the minimum. Credits can help if you were caring, unemployed or ill.

National insurance gaps: fix or live with them?

You can sometimes boost your record by paying voluntary NI (Class 3) for past years. The value depends on your history and whether you’re already on track for the maximum. Some will gain hundreds of pounds a year for life by adding a single qualifying year; others will gain nothing if they already expect the full amount.

One extra qualifying year can add roughly 1/35 of the full new State Pension — around £300 to £330 a year before tax, for life.

Before paying, get a State Pension forecast and NI record. Confirm whether credits apply, for example if you received Child Benefit, Carer’s Allowance or Universal Credit in relevant years. Ask for personalised guidance if you have periods of contracting‑out or a mix of pre‑2016 and post‑2016 history.

Money impact: what a later start means

A delay means weeks without that income. The current new State Pension sits at roughly the low‑£200s per week. Use the figures below as planning maths, not exact promises.

| Delay length | Pension not received (at ~£220/week) | Possible upside | Notes |

|---|---|---|---|

| 3 months (~13 weeks) | ~£2,860 | Chance to add a qualifying year | Worth checking voluntary NI vs. future uplift |

| 6 months (~26 weeks) | ~£5,720 | Extra savings or debt reduction | Weigh work income against forgone pension |

| 12 months (52 weeks) | ~£11,440 | Potential to defer for a higher weekly rate | Cashflow planning becomes crucial |

Deferring your claim deliberately

Deferral can lift your weekly payment permanently. For those on the new State Pension, each nine weeks of deferral adds about 1% to your pension, a shade under 5.8% for a full year. That increase is taxable income when paid.

Defer for a year and your State Pension typically rises by roughly 5.8% for life — but you miss a year of payments.

Deferral suits people with other income, solid health prospects and a long planning horizon. It rarely suits those needing cash now or claiming means‑tested support, where deferral can reduce entitlements.

Planning moves you can make now

- Check your forecast and SPA date using the government’s calculator.

- Review your NI record for gaps and credits; decide whether voluntary NI adds value.

- Map cashflow for the months around your new SPA: savings drawdown, part‑time work, or bridging funds.

- Coordinate with workplace and personal pensions: adjust drawdown rates, consider annuity quotes, and manage tax bands.

- Rebalance investments for near‑term spending needs: raise cash buffers and reduce sequence‑of‑returns risk.

- Update your benefits check if your start date moves: Pension Credit, Council Tax Reduction and other support may shift.

- Talk to your employer about flexible hours or a phased exit; keep earning NI if it helps you reach a qualifying year.

Frequently asked questions

Will everyone have to wait longer?

Those reaching SPA from October 2025 face the change. People already over SPA or with claim dates before then are not pulled into the new timetable.

Does this change how much I get each week?

The weekly rate still follows government uprating policy. What changes for many is eligibility timing and the effect of NI gaps on the amount paid.

How do I protect my full amount?

Build enough qualifying years, make sure credits are on your record, and consider voluntary NI only if it boosts your forecast. Keep evidence for caring responsibilities and periods on benefits.

Can I work and claim the State Pension?

Yes. You can work while claiming. The State Pension counts as taxable income, but you do not pay employee NI once you’re over SPA. Your wages may still be taxed depending on your total income.

What about private and workplace pensions?

They are separate. You can start them earlier to bridge a later State Pension start, or delay them to keep tax efficient. Track annual and lifetime tax limits when you contribute or draw down.

Extra pointers and real‑world examples

A 66‑year‑old who expected to claim in November 2025 might face a six‑month wait. If they can work two days a week at £12 an hour, 16 hours a week brings ~£192 before tax, softening the gap while potentially adding to NI where applicable. If health, caring or job options block this, a cash reserve covering six months at basic living costs becomes the priority.

Someone with 34 qualifying years could get close to the full amount by adding one year. If a Class 3 top‑up costs a few hundred pounds for that year and increases their State Pension by roughly £300–£330 annually for life, the payback can arrive quickly. That said, returns vary. Confirm your numbers before paying.

If you are weighing deferral, run two timelines: take the pension immediately and invest/spend it, or defer and accept the uplift. Compare breakeven ages and tax positions. Health, partner income and benefit eligibility all shift the answer.

Finally, set a review date. Policies change, markets move and personal plans evolve. A short annual check on your SPA date, NI record, pension withdrawals and tax position keeps you ready for the October 2025 rules and whatever follows next.

If I hit SPA in Nov 2025 with 34 qualifying years, is paying Class 3 for one more year still worth it, or do the tighter eligibility rules change the payback math?

So “financial sustainability” means moving the goalposts months before retirement? Some of us planned around 66—now we eat the gap while prices rise. Any protetions for those within 6 months of their date?